State of Home Care Report 2025

The UK homecare sector enters 2025 in a period of significant transition and pressure. Building on insights from CareLineLive’s 2024 State of Home Care Survey, this year’s report draws on responses from providers across England, Scotland, Wales and Northern Ireland. It outlines the major forces reshaping the sector, from workforce shortages and recruitment barriers to mounting burnout, rising demand, funding constraints and the evolving influence of digital systems.

2025 State of Home Care survey findings

This year’s findings show a sector feeling the weight of intensifying challenges. Recruitment obstacles, particularly around driving and transport have grown more severe. Staff pressure is increasing, client needs are becoming more complex and providers are struggling to keep pace. Meanwhile, digital tools continue to gain traction, offering operational efficiencies but falling short of addressing the deeper structural and financial issues facing the sector.

Through direct comparison with 2024, this report highlights where conditions have worsened, where they have stabilised and where signs of improvement are emerging. Together, these insights offer a clear view of a sector navigating heightened expectations with limited capacity and a growing need for strategic support.

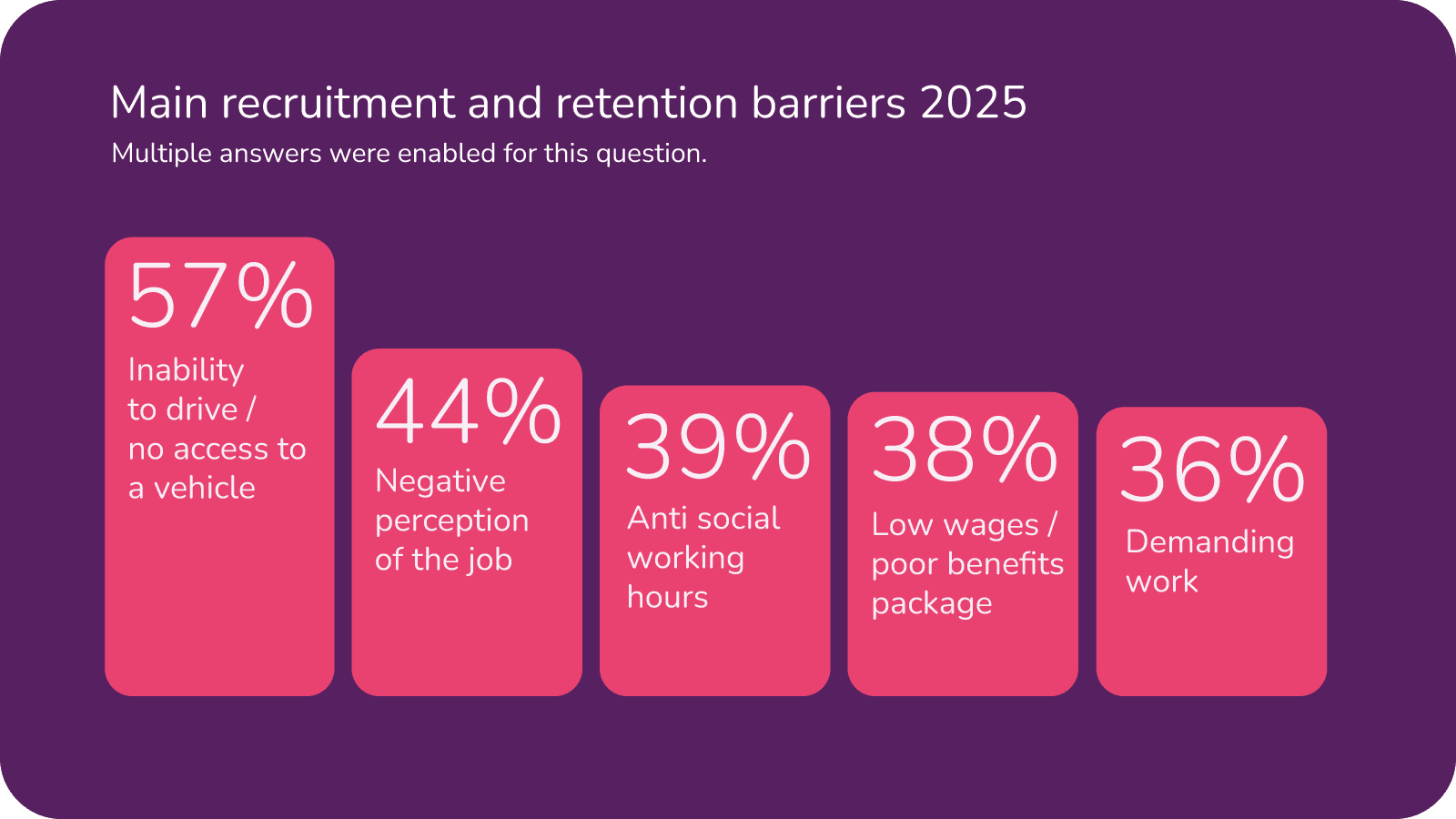

Recruitment and retention: What is discouraging new entrants?

Driving (or access to a vehicle) remains the dominant structural barrier, affecting more than half of providers. This was a surprise finding in 2024 and continues to grow as a key challenge. Pay and working conditions are critical, but public perception of care work is also a major deterrent.

Top barriers

“The biggest barrier to recruitment isn’t pay – it’s finding people who can drive.”

“Transport is a deal-breaker – without a car, carers simply can’t reach people.”

Note that as multiple responses were required, percentage numbers will collectively add up to more than 100%. So for clarification, of those providers questioned, 57% stated that inability to drive was a significant recruitment and retention barrier.

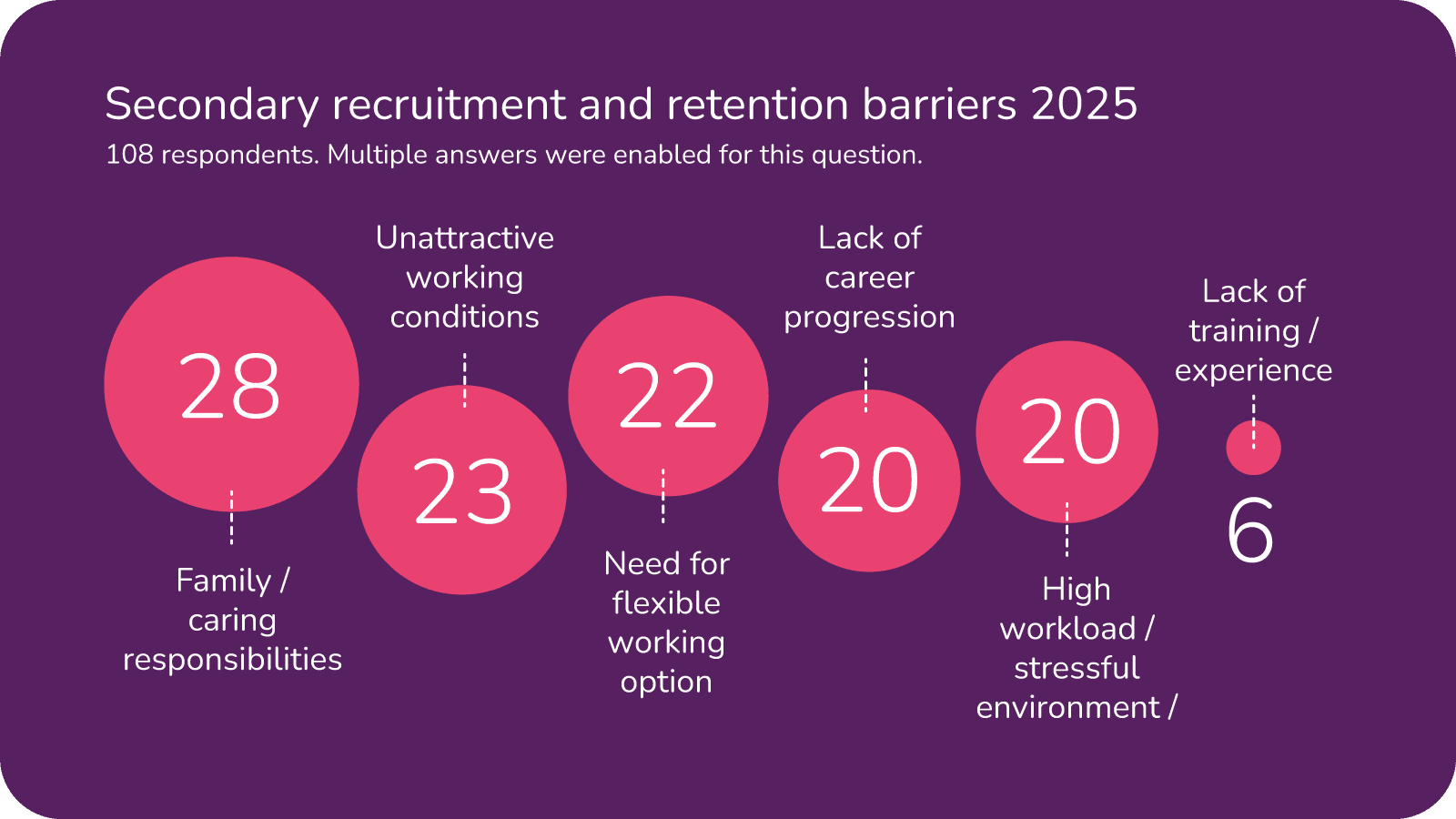

Secondary but significant factors

Family and caring responsibilities, flexibility and career progression play a role, but remain secondary to issues of pay, transport and job image.

“Care workers deserve recognition as professionals – without that, recruitment will never improve.”

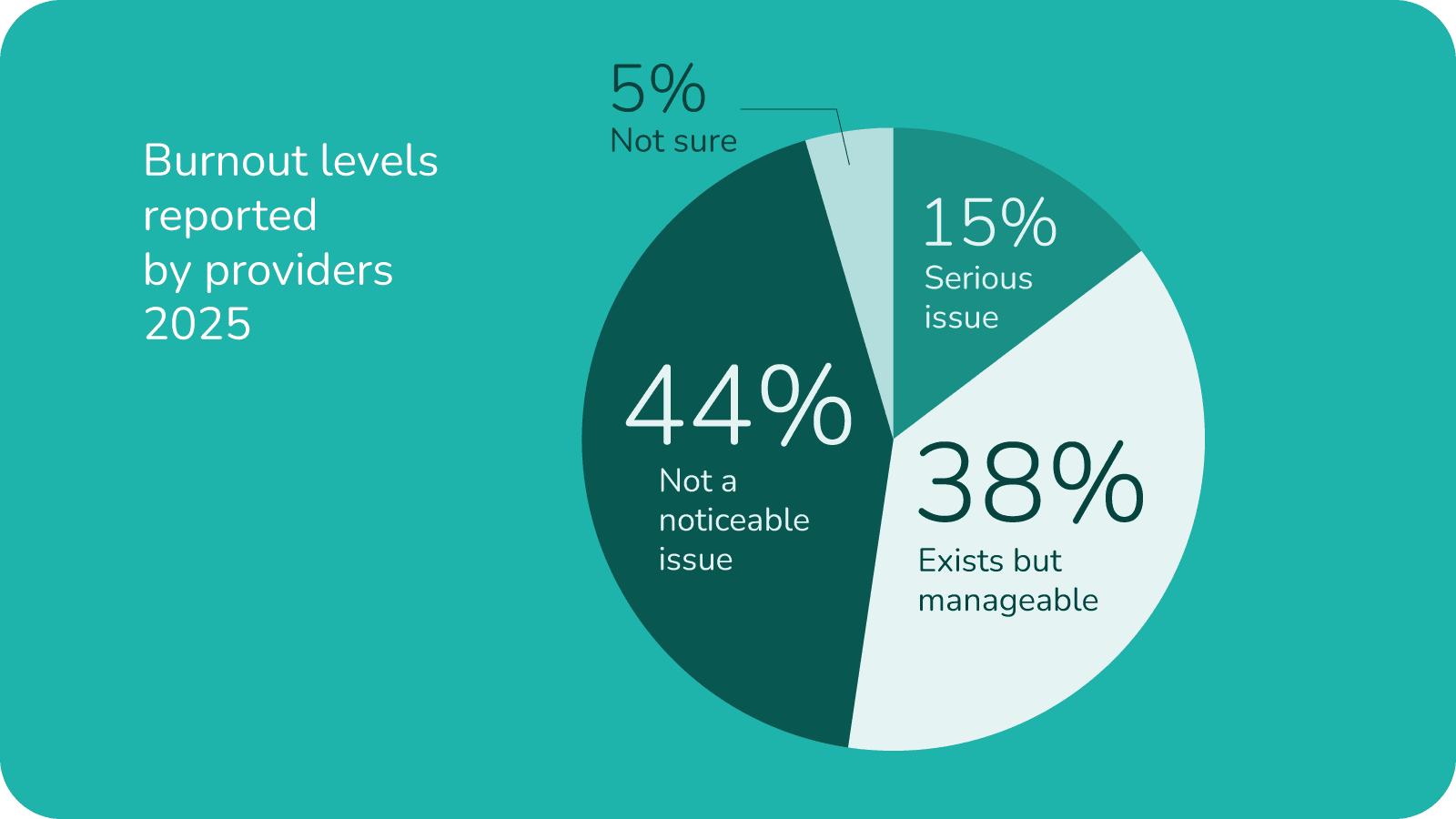

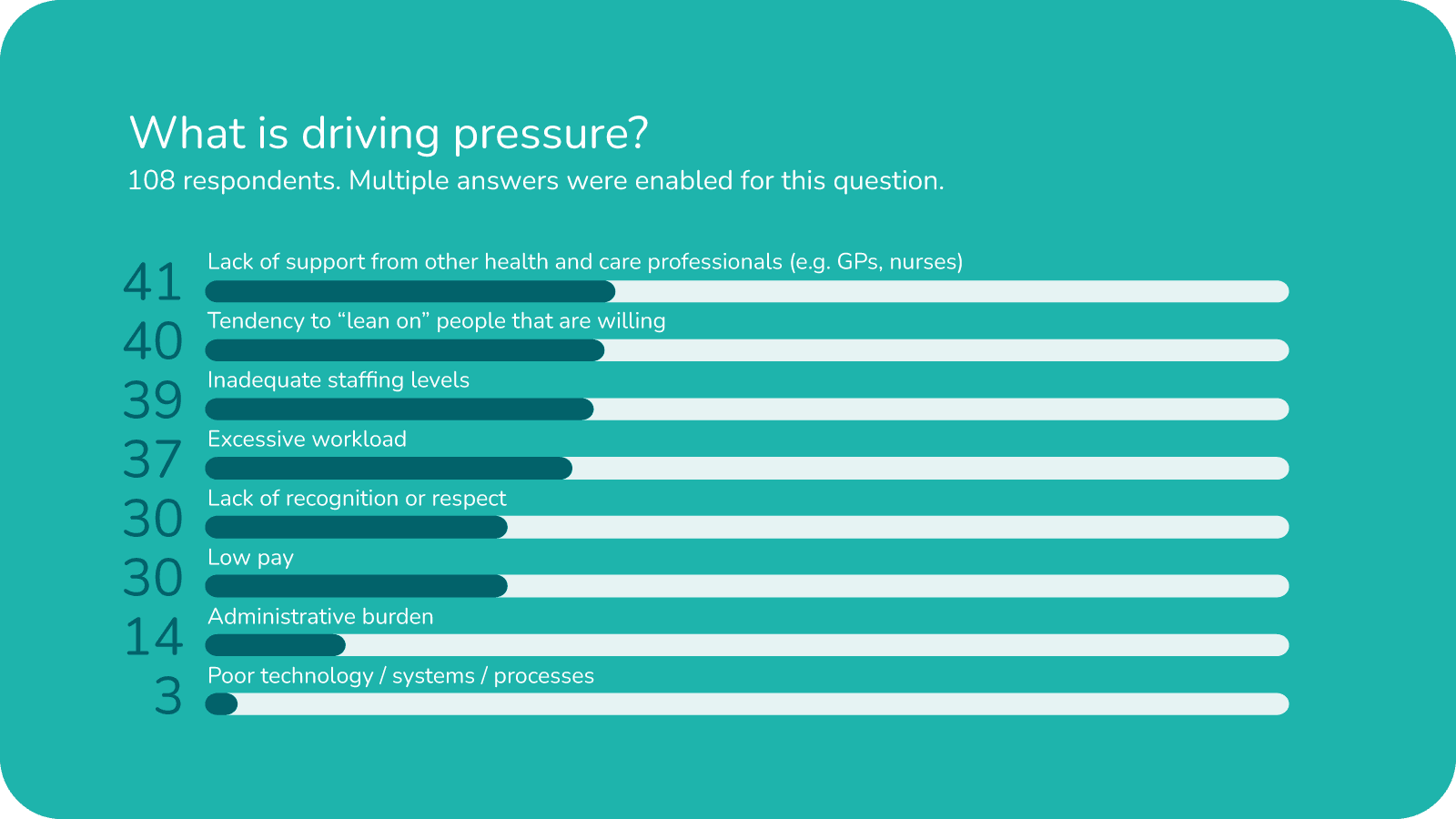

Burnout, workload and workforce pressure

Staffing shortages, workload intensity and over-reliance on a small number of willing staff are the leading drivers of pressure. Recognition and respect are cited as often as pay when describing workplace stress.

Experiences of burnout

More than half of providers see burnout as a current or emerging concern, though only a minority view it as “critical”.

“Staff burnout is real. We’re constantly plugging gaps just to keep people safe.”

Drivers of pressure

Lack of support from other health and care professionals was the leading driver of pressure with 38% of respondents citing this issue.

Very few providers point to software or digital systems as a root cause, suggesting digital adoption should be seen as an enabler, not a cure-all.

Ability to meet demand

- Many providers are meeting demand only up to a limit

- Key constraints include staffing shortages, recruitment challenges, transport issues and hospital discharge patterns

- Local authority rates were repeatedly cited as a fundamental blocker, providers want to recruit, pay competitively, train staff and accept more packages, but council rates do not cover the true cost of care delivery

- Concerns are rising around safety, sustainability and pressure on teams

- Most frequent responses included the words which provide useful insights: training, staff, support, time, carers, impact, additional

“We’re meeting demand but only just. One more referral and the whole rota collapses.”

“Hospital discharge teams expect instant starts but we can only do so much with the staff we have.”

Increasing complexity of need

Emerging themes:

- Growing complexity is demanding more staff time

- Providers stress the need for upskilling and additional resources

- Providers often receive late or incomplete NHS data, leaving staff unable to plan care safely and manage rising client complexity

“Client needs are getting more complex but the training and guidance hasn’t kept pace.”

“We often receive NHS information too late to plan care safely.”

“It’s hard to deliver complex care when we’re missing key medical details.”

“We spend too much time chasing information that should come automatically from the NHS.”

Pay and funding: Competitive or constrained?

Many providers cannot offer competitive wages within current local authority or NHS-funded rates; some rely on private clients to subsidise pay or restructure rotas to make pay packages appear more attractive; funding constraints are directly hindering recruitment and retention efforts.

“We can’t offer competitive pay on current funding levels.”

Software

Digital systems and software

Use of home care management systems

“Digital systems have made scheduling and record-keeping far easier – we simply couldn’t manage on paper anymore.”

“Having real-time information in one place makes delivering safe, reliable care much easier.”

“Technology helps families feel involved – they can see updates instantly.”

“As client needs become more complex, technology is essential for coordinating care safely.”

“Technology doesn’t replace people, but it makes the workload safer and more manageable.”

“ Good software gives us clarity – we can see risks and urgent issues straight away.”

“Without digital tools we simply couldn’t run the service efficiently.”

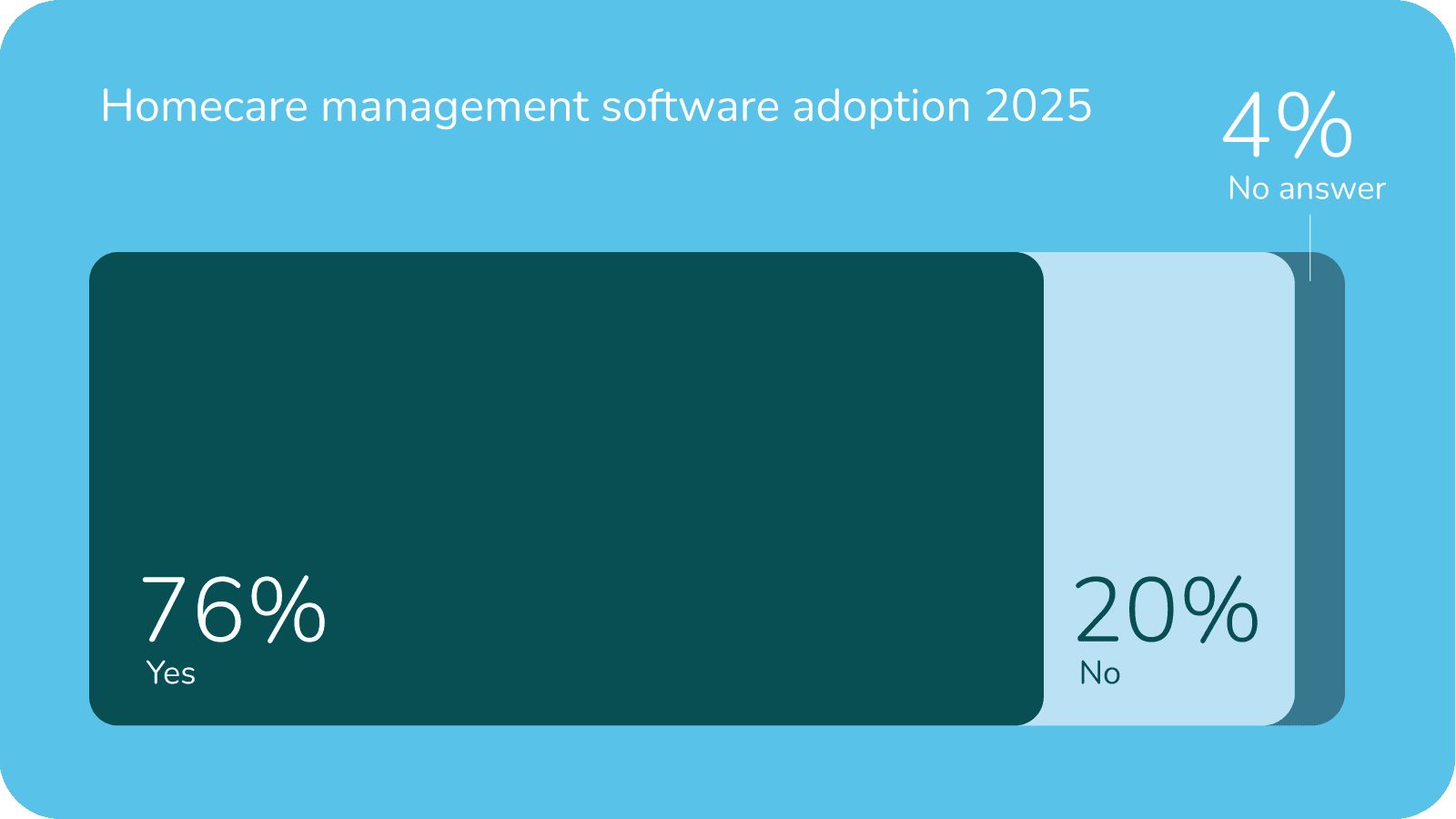

Around three quarters of providers surveyed are now digitised, with an additional 14% expressing interest in adopting digital tools.

Data sharing with the NHS

There is a clear need for more consistent data sharing, improved interoperability and better-quality information.

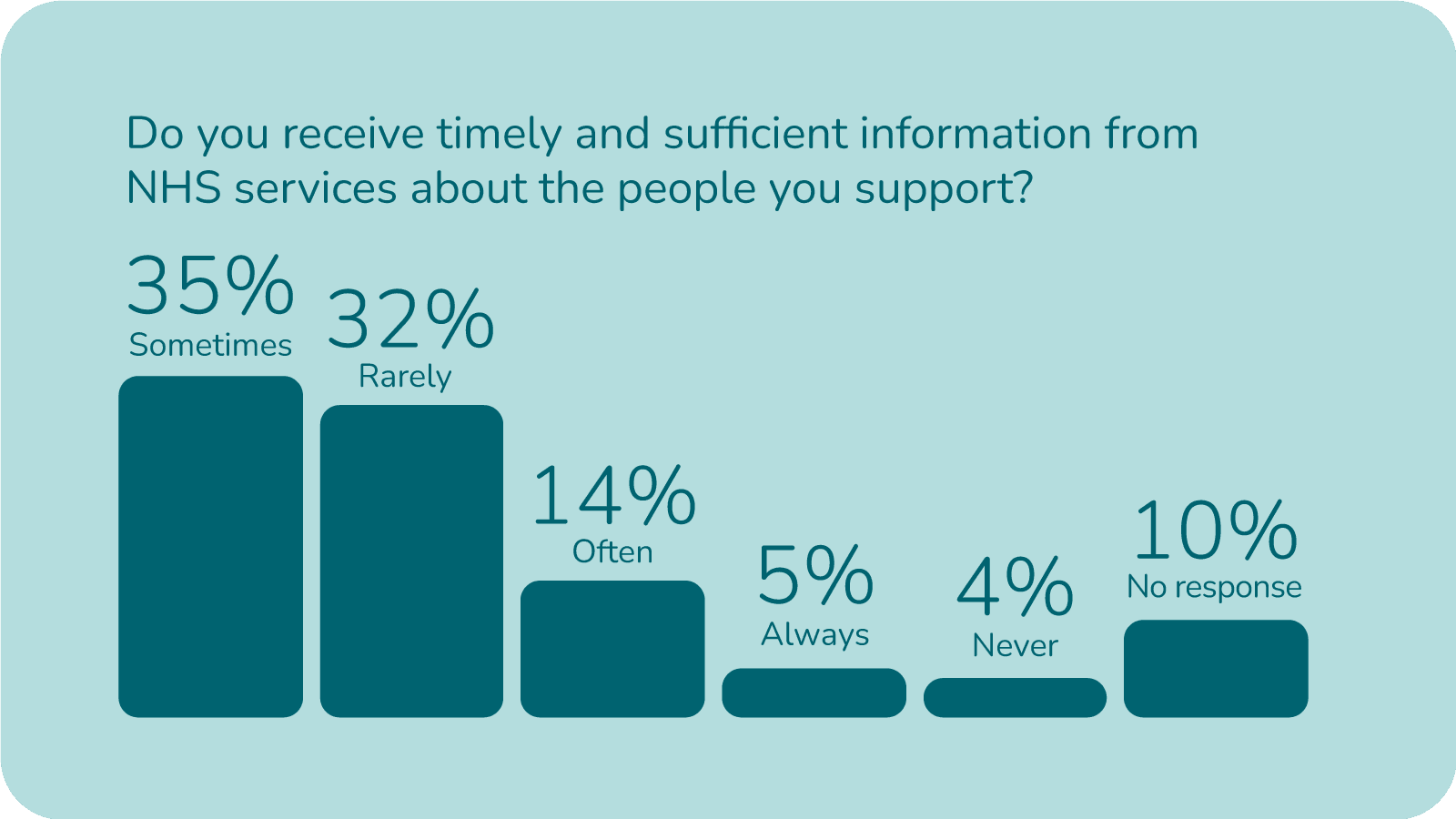

Timeliness and sufficiency of NHS information

The majority of providers rarely or only sometimes receive proper patient information. Only a small minority feel they regularly get timely, sufficient information.

This matches the wider survey story: providers operate without complete or timely NHS data most of the time.

“Being unable to access NHS systems leaves us caring for people with incomplete information.”

“The whole system relies on us, but we’re still working with outdated, incomplete information.”

“We’ve invested in digital tools, but the NHS data gaps mean we can’t unlock their full value.”

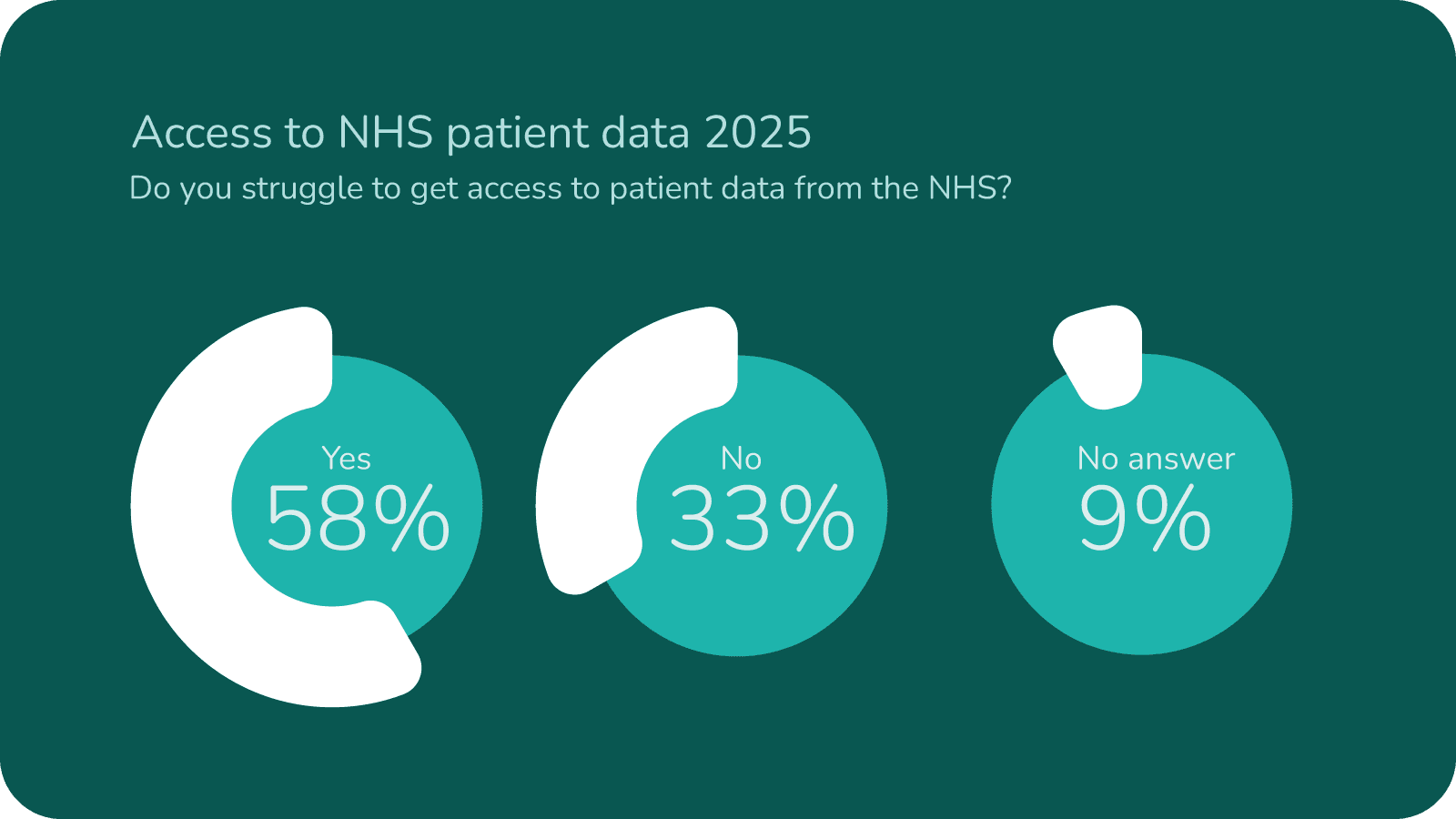

Challenges in accessing NHS information

Gaps in data flow from the NHS affect care planning, responsiveness and coordination with hospitals and GPs. The findings point to an ongoing divide between health and social care, adding pressure on frontline teams and contributing to preventable inefficiencies.

There is a clear need for more consistent data sharing, improved interoperability and better-quality information.

“We often have to care for people without essential medical details – it feels unsafe.”

“We’re saving lives with only half the information we need.”

“Technology helps, but only if NHS systems talk to each other.”

Access to timely, adequate information from NHS services remains inconsistent. Only 19% of providers “often” or “always” receive the information they need to support safe care. Nearly two-thirds report receiving sufficient information only “sometimes” or “rarely,” creating operational delays and uncertainty.

“The NHS expects us to prevent hospital admissions – but doesn’t share the data that makes that possible.”

“Care staff are burning out while waiting for NHS updates.”

“If we had the right information at the right time, half our crisis could be prevented.”

Year-on-year comparison: 2025 vs 2024

What has worsened

Growing workforce pressure and stronger indicators of burnout

Increasing difficulty meeting demand

What has stayed consistent

What has improved

Digital adoption

Digital adoption continues to climb, with 76% of respondents now using home care management software

Care digitisation

Other UK government research into the entire social care sector indicates that 80% of providers now use digital social care records, helping almost 90% of people receiving care

Survey sample

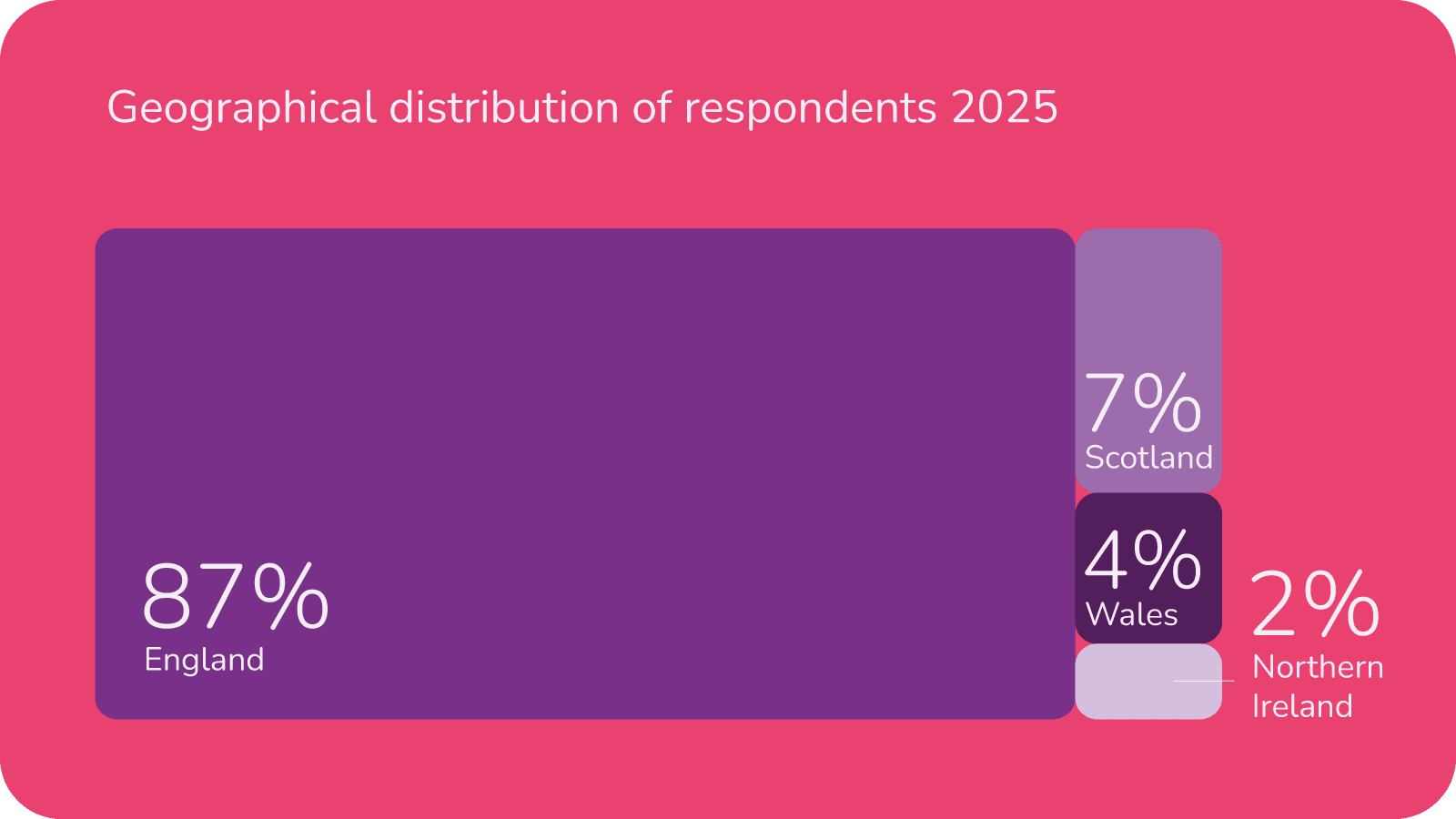

The 2025 survey sample is larger and more geographically diverse, reinforcing consistency with ongoing provider feedback

Respondent profile

108 responses were collected, representing all regions of the UK:

- England: (87%)

- Scotland: (7%)

- Wales: (4%)

- Northern Ireland (2%)

Workforce size

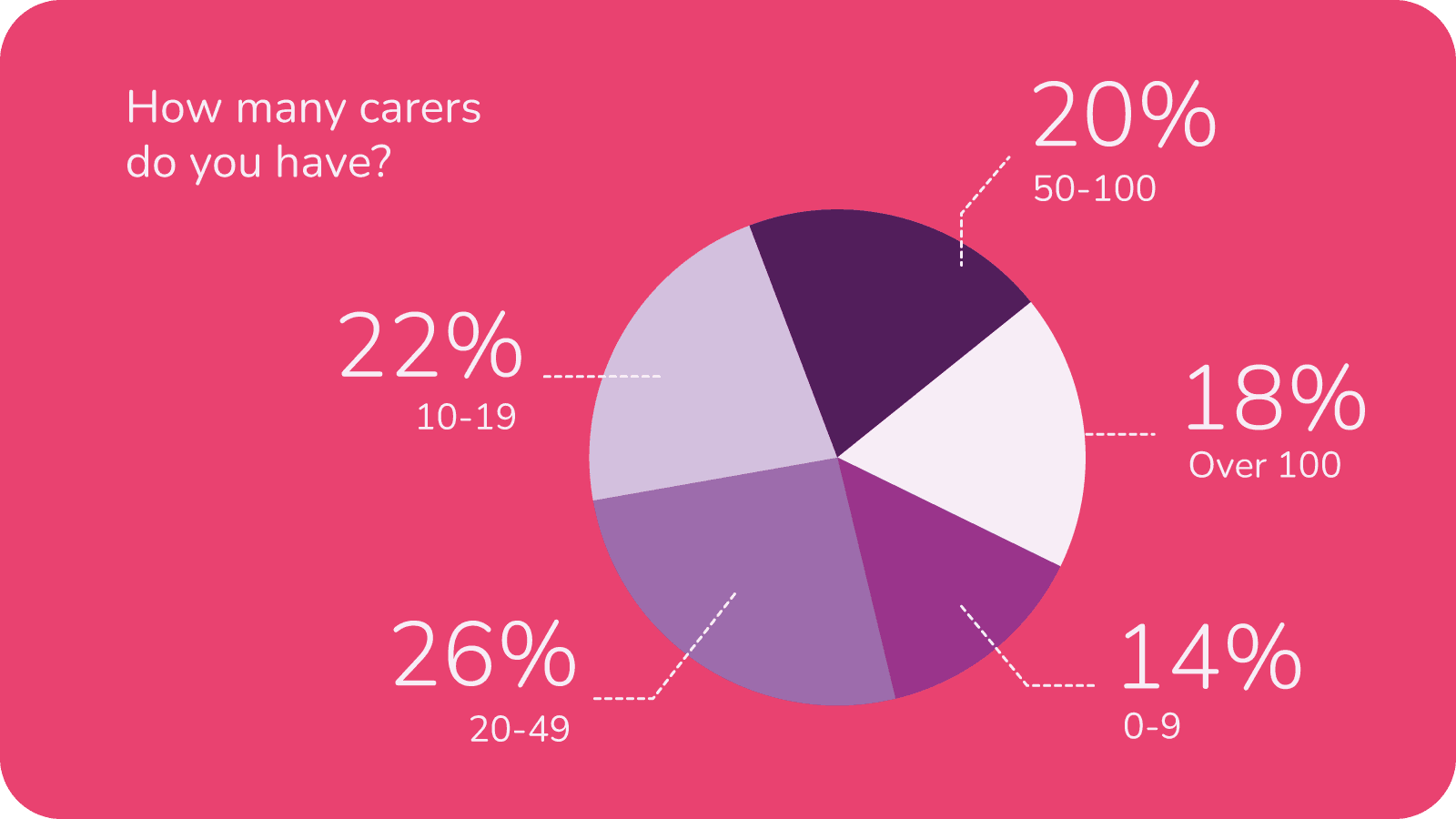

Rather than look at the number of service users supported we asked providers how many carers they employ.

A balanced mix of small, medium and large providers responded, with a slight leaning toward mid-sized services.

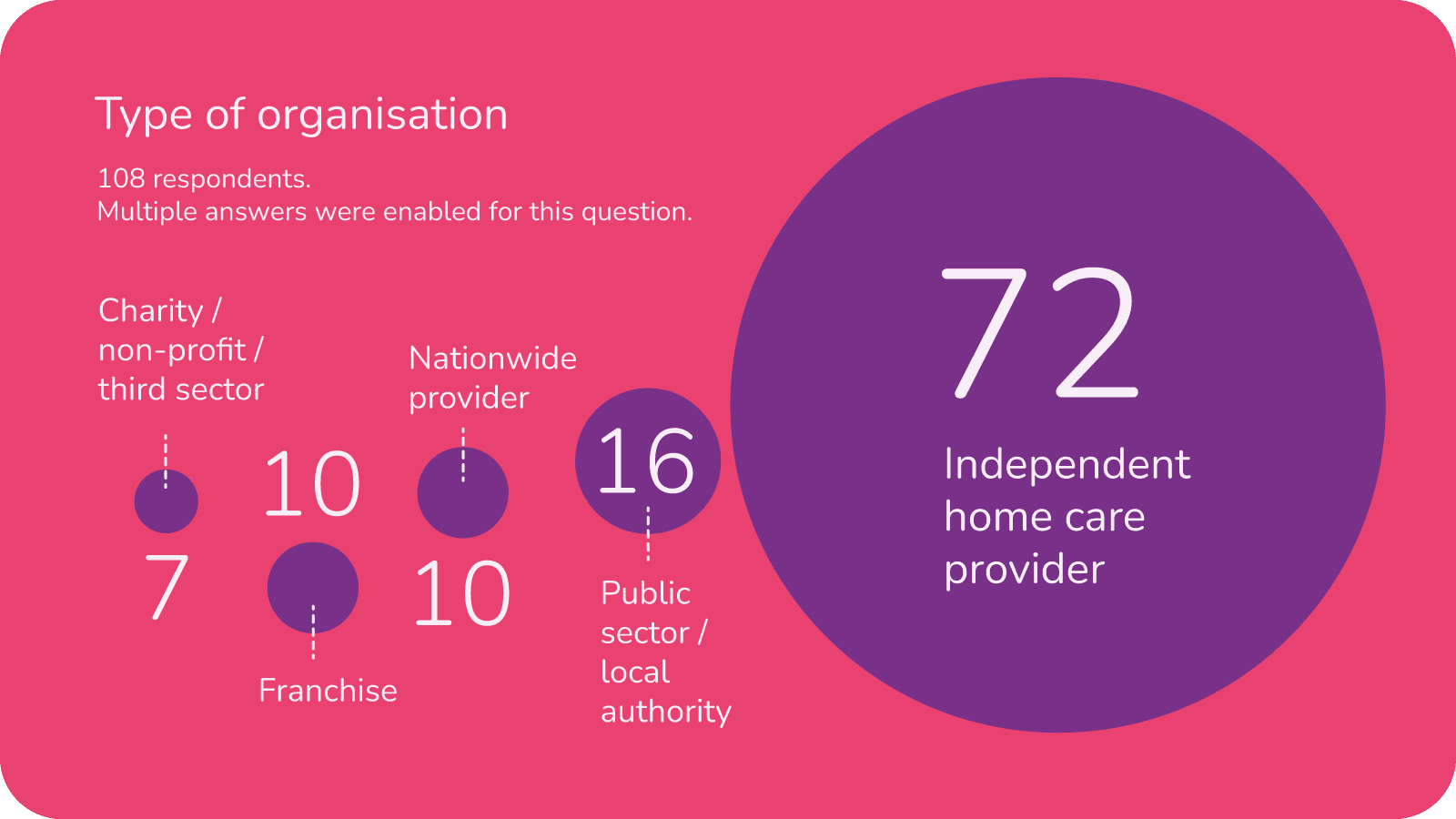

Type of organisation (multiple answers were available)

The type of organisations taking part in the survey represented a broad mix with providers from the public and charitable sectors as well as private home care providers. A good selection of franchises and national providers were also represented.

Overall summary

This year’s findings

The 2025 homecare landscape is one of mounting strain. Recruitment barriers, particularly those linked to driving and transport are worsening. Complexity of need continues to rise while wages, staffing levels and access to NHS information remain insufficient. Burnout is becoming an increasingly important trend to monitor and many providers are coping only “to a point” as demand grows.

Digital adoption is improving steadily, but it must be viewed as a tool to support, not to solve the sector’s deep-rooted challenges in funding, workforce resilience and operational integration.

Looking ahead

As the sector faces another year of intensifying pressures, incremental changes will not be enough. Providers continue to demonstrate resilience, adaptability and commitment despite constrained resources and rising expectations.

To maintain sustainable, high-quality care, the system surrounding homecare must also evolve, including funding reform, improved NHS data flow and genuine health and social care integration. With the right support, the sector can not only withstand today’s pressures but build a stronger, more responsive foundation for the future.

Partnership with the Care Workers Charity

A £250 donation was made to the Care Workers Charity as thanks for their help in promoting this survey. Responses by additional questions set by the charity are reported by them separately.