The Uk’s home care crisis

If you are a home care provider or a member of the CareLineLive community, you are likely to be witnessing the home care crisis and challenges within the system on a daily basis, delayed care plans, overworked staff, and families who are anxious and overwhelmed. The UK’s home care sector is currently facing significant pressure and those delivering care are experiencing the brunt of it.

As demand increases and resources become limited, understanding the extent of the challenge is crucial. Here’s what the latest data reveals and how it impacts your teams, your clients and your business.

Demand is surging and so are delays

By early 2025:

- 673,000 people are receiving local authority-funded long-term adult social care in England

- 488,000 (72.5%) of them are being supported in their own homes or community settings

- 137,000 people were receiving support in residential care homes (300 per 100,000 adults)

- 55,000 people were receiving support in nursing homes (120 per 100,000 adults)

- 230 people were receiving support in prison

- 400,000 people are still waiting for assessments or care to begin

This backlog means your teams are under pressure to pick up the slack and often facing complex cases with urgent needs and minimal preparation time.

Unpaid carers are struggling too

Beyond formal services the care system is underpinned by 5.8 million unpaid carers, many of whom eventually turn to providers for support. With 1.7 million giving over 50 hours of unpaid care each week burnout is a growing risk.

Why this matters for providers:

- Carer breakdowns often trigger emergency care requests

- Families may delay recruiting professional help, increasing risk and complexity

- Supporting unpaid carers with flexible packages and respite options can build trust and long-term relationships

Staffing: The sector’s biggest bottleneck

The numbers paint a stark picture:

- The homecare workforce includes 809,000 people

- There’s a 13% vacancy rate in social care, four times the UK average

- Turnover is currently 30.6% in domiciliary care vs. 27.4% in care homes

- 84% of providers say they struggle to recruit

This isn’t news to you, but it underscores why retention, training and digital support tools (like those from CareLineLive) are more critical than ever.

Many providers now rely on international recruitment, however, recent visa changes and post-Brexit rules make this a fragile strategy. Home Office statistics show that entry visa grants for care workers and senior care workers in Q1 2024 were 84% lower than in Q4 2023, and 87% lower than in Q1 2023.

As announced by Home Secretary Yvette Cooper, the UK will cease the recruitment of care workers from abroad later this year. Consequently, care providers will no longer have the ability to sponsor new international care workers through the Health and Care Worker visa route. Instead, they are encouraged to recruit from the domestic labour market or consider individuals already residing in the UK under various visa categories.

Long-term solutions must prioritise enhancements in pay, working conditions and recognition to effectively address the recruitment and retention challenges within the sector. You can download CareLineLive’s recruitment white paper here.

Funding falls short

The Homecare Association estimates that the sustainable hourly rate for care is £32.14. Yet, local authorities typically fund only £28.53, leaving providers with impossible choices.

More than half of providers say they may reduce services or close if funding doesn’t improve. At CareLineLive, we find that many are increasingly reliant on private contracts for economic survival.

Understanding your cost base and demonstrating value, especially through data can strengthen your position when negotiating with commissioners.

The future: rising demand, an ageing population

Looking ahead:

- By 2037, the number needing 24-hour care will double to 446,000

- By 2073, 27% of the population will be over 65

- Dementia cases are projected to hit 1.6 million by 2040

Rural areas have a significantly higher proportion of older residents, with 25.4% aged 65 and over, compared to 17.1% in urban areas. The average age in rural villages and dispersed areas reached 45.9 years in 2020, compared to the national average of 40.3 years. This demographic trend is driving increased demand for healthcare services, especially for chronic and age-related conditions.

This highlights the need for smarter rostering, travel time optimisation and flexible scheduling, all areas where CareLineLive can support your growth and efficiency.

What’s changing?

Some positive steps are underway:

- A £3.7 billion funding boost is planned for 2025/26

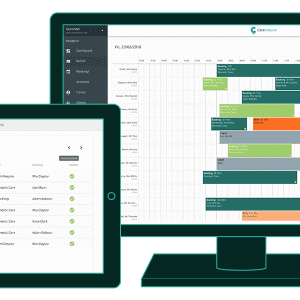

- Investment in digital transformation is expanding including care management platforms with around 80% of providers now using digital social care records

- There are growing calls for a National Care Service

Still, these changes will take time. For now, providers need tools, insights and support to survive the immediate pressures.

The bottom line for providers

You’re not just delivering care, you’re holding up a system under strain.

To meet rising demand and growing complexity care providers need:

- Sustainable funding

- Workforce stability

- Better use of technology

- Recognition of the essential work you do

Platforms like CareLineLive are here to support you, not just in streamlining operations but in giving you the insights and data to advocate for your staff and clients.

Continue to raise your voice and share your stories, the future of homecare relies on your contributions.