Currently, the overall sentiment among home care providers is one of cautious optimism tempered by immediate concerns over workforce shortages, funding challenges and increasing demand. While technological advancements and policy reforms offer hope for long-term improvement, many providers feel stretched and worry about sustaining services under current conditions.

The recent efforts to alleviate the issues surrounding government funding have been met with some approval. However, there remains a significant shortfall in the budget allocated to the social care sector, prompting widespread concern. The UK government has announced substantial funding initiatives to support the persistent challenges faced by this vital sector.

UK Government funding

An additional £3.7 billion has been allocated to social care authorities for 2025–26 as part of the Local Government Finance Settlement. This includes:

- £880 million specifically for the Social Care Grant, which supports both adult and children’s social care needs

- £515 million to help councils manage increased employer National Insurance Contributions (NICs) across all service areas

Growing public awareness of the role of social care

In 2025, public interest in social care within the UK has surged, influenced by demographic, economic and systemic factors. Providers are increasingly recognising the rising public awareness regarding the essential role of home care in supporting vulnerable populations. This growing consciousness may lead to enhanced investment and improvements in policy.

Key areas of public concern and engagement include:

The aging population and demand for care

The UK’s ageing population has highlighted the urgent need for robust social care services. A rising number of individuals now require long-term care, whether at home or in residential facilities and delivering care effectively has become increasingly challenging. This escalating demand has exerted additional pressure on the system.

The demand for social care in the UK is rising significantly, driven by demographic shifts, increasing complexity of care needs and systemic challenges. Many individuals now require more complex and specialised care due to ageing-related conditions and post-pandemic health issues. This has placed additional strain on the system.

There is a stark mismatch between the high demand for home care services and the insufficient supply available to meet that demand. These factors collectively highlight the urgent need for systemic reforms to address workforce shortages, improve funding mechanisms and enhanced service delivery to meet the growing demand for social care in the UK.

Challenges for service providers

- Staffing shortages: Recruitment remains a critical issue, with 84% of providers struggling to hire skilled workers. Job vacancies in domiciliary care are four times higher than the UK average

- Financial pressures: Rising costs from budget measures threaten the viability of many providers, especially those serving state-funded markets. Small, local operators are particularly vulnerable due to thin margins

- Regulatory compliance: Persistent issues with the Care Quality Commission (CQC) have delayed operational processes, adding strain on providers

- Demand vs capacity: Almost half of home care providers cannot meet the current demand for services, exacerbated by the ageing population and increasing complexity of care needs post-pandemic.

Improving employment practices, such as fair pay and working conditions, is crucial but not sufficient to address the larger issues of supply and demand. Despite some improvements in staff retention, many providers still struggle to fulfil service needs due to insufficient funding and competitive pay, raising concerns over the quality of care.

Integration with the NHS

Public awareness is growing regarding the influence of social care on NHS performance. Challenges such as delayed hospital discharges stemming from inadequate social care support, have highlighted the urgent need for improved integration between health and social care services.

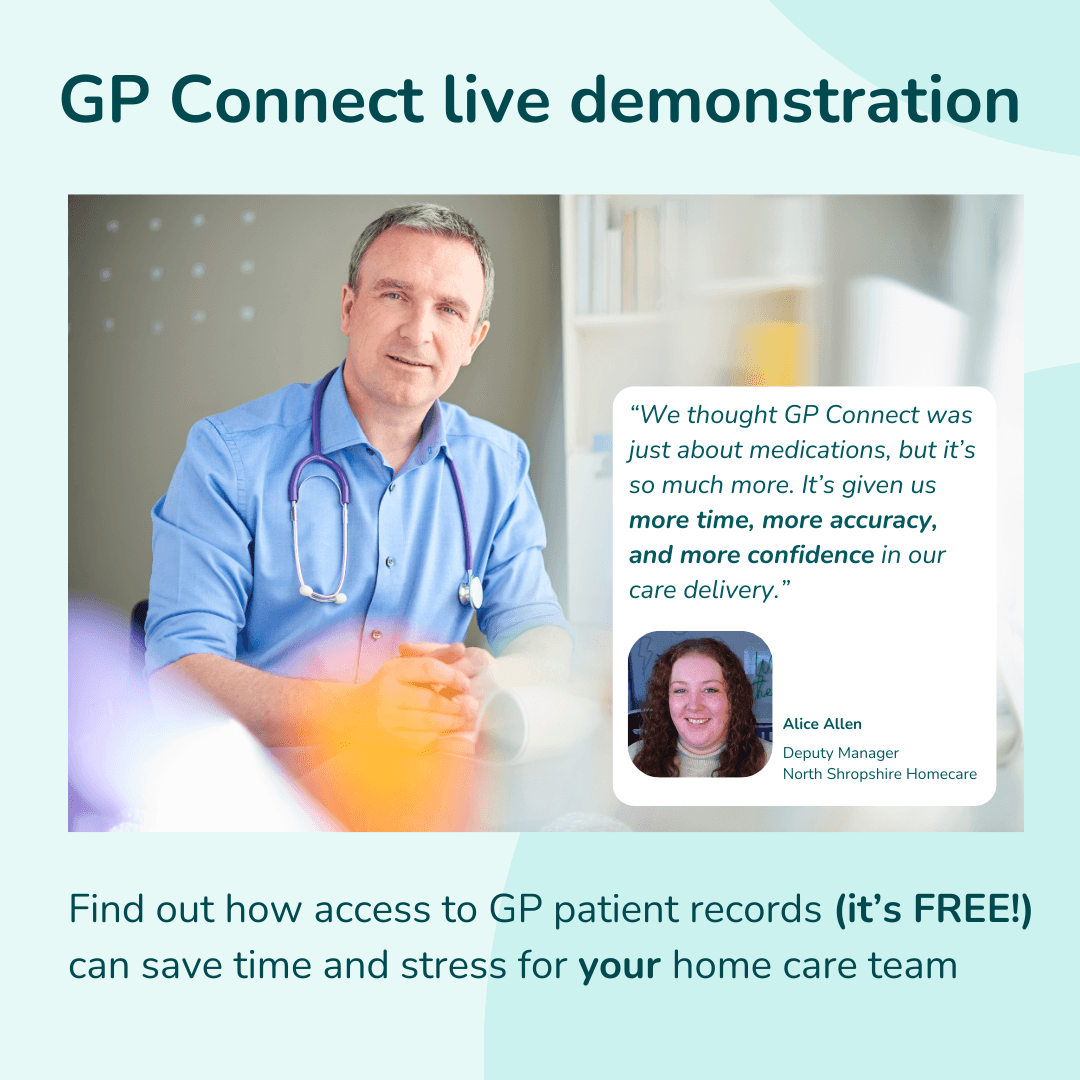

In response, industry stakeholders including digital software companies like CareLineLive, are actively working towards better integration with the NHS to enhance service user outcomes. A recent development in this effort is the launch of GP Connect by CareLineLive, which enables home care providers to access crucial medical information about service users.

Shaping a new innovative sector

Despite the challenges faced by the sector, there is a palpable sense of optimism as many providers are embracing change and exploring innovative collaborative approaches to address sector demands. Local Care Associations play a crucial role in uniting providers from various segments of the sector, fostering cooperation to tackle local challenges.

Notable examples of this collaborative spirit include the Yorkshire Care Alliance and LinCA, which exemplify how providers can unite to achieve improved outcomes for services and the individuals who rely on them.

Integration of technology

Many providers are optimistic about the role of technology in improving efficiency and service delivery. Telecare solutions and digital platforms are increasingly being adopted to address staffing gaps and enhance care coordination.

Artificial Intelligence (AI) is increasingly used in home care to enhance service delivery. Wearable devices and AI-powered apps monitor health metrics like blood pressure, blood sugar levels and medication administration. Motion detectors and predictive analytics tools empower caregivers to proactively address issues like falls and early signs of illness, rather than responding reactively. This proactive approach ultimately has a positive impact on the broader healthcare sector.

Digital records

As of 2025, approximately 95.5% of home care providers in the UK are using digital systems, partially or exclusively, to support care delivery. Additionally, the Digitising Social Care Programme aims for 80% of providers to have digital social care records by March 2025, with this target reportedly on track. While adoption rates are high, dissatisfaction with existing systems and barriers to complete digitalisation persist.

A pivotal moment for the UK’s home care sector

The UK’s home care sector is currently at a crucial crossroads, characterised by significant challenges and promising opportunities. As the sector faces acute staffing shortages, financial pressures and rising demands for care there is a burgeoning sense of cautious optimism among providers.

Public awareness of the essential role that social care plays, especially in light of an ageing population and its implications for NHS efficiency have reached unprecedented levels. This shift in perception could pave the way for more substantial investment and meaningful policy reforms.

Technology and innovation are catalysing a quiet revolution in care delivery. AI integration, digital platforms and data-sharing tools such as GP Connect are enhancing care coordination and empowering providers to operate more efficiently, even in the face of workforce shortages. Rapid digital adoption across the sector is further bolstered by national programmes to modernise care delivery.

Despite persistent operational and regulatory challenges, the rise of collaborative networks including local care associations signifies a sector increasingly open to embracing change and working together to improve outcomes. With ongoing innovation, strategic investments and the integration of health and care services, the home care sector not only has the potential to navigate the current challenges but also to emerge stronger and more resilient than ever.